Instant loan apps have gained popularity in India due to their ability to offer fast and convenient access to funds for various purposes. These apps usually provide small to medium-sized loans with minimal documentation and offer instant approval and disbursement of funds to borrowers. They have become a popular choice among young professionals and those in need of emergency funds. However, the rise of instant loan apps has raised concerns about the high-interest rates, which can lead borrowers to fall into debt traps. That’s why, it is essential for borrowers to carefully evaluate their financial situation and borrowfunds from trusted apps.

With hundreds of options available in the market to get instant loans, we have listed the 10 best personal loan apps in India, that offer you instant personal loans for all your needs and urgencies. All of these apps and their lending partners are registered with RBI and have a safe and secure transaction process. You can customize and get a loan of your choice with aflexible EMI repayment period and an appealing interest rate.

10 Best Personal Loan Apps in India for Instant Loan

Contents [hide]

1. Money View

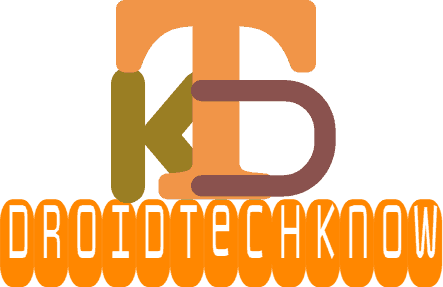

Money View is one of the best personal loan apps to get an instant loan ranging from ₹10,000 to ₹5,00,000 with APR (Annual Percentage Rate) varying from 16% to 39%. You can opt for flexible EMI repayment plans which start from 3 months and goes up to 5 years. Money View’s easy-to-apply loan process and 100% transparency make it a highly-rated and trusted appwitha user base of over 1 crore. They offer collateral-free personal loans with 24 hours disbursal period. You can easily apply for a personal loan, educational loan, bike loan, car loan, business loan, etc. All you needis your identity proof, address proof, and income proof.

Features:

-

Easy to apply process

-

Various types of loans are available

-

Loan amount starts from ₹10,000 to ₹5,00,000

-

Safe and secure with 256-bit encryption

-

Fully transparent with no hidden charges

-

EMI repayment plans vary from 3 months to 60 months

-

Personal loan for both salaried and self-employed

-

Maximum disbursal period of 24 hours

2. KreditBee

KreditBee is a popular app that offers a trustedplatform for people who need personal loans. It provides personal loans from ₹1,000 to ₹4,00,000 with interest rates varying from 0% to 29.95% per annum for both salaried and self-employed people. All loan applications are approved and sanctioned by Banks that are registered with the RBI. The application process is simple and hassle-free. You can expect your loan to be credited within 10 minutes. So in simple words, low-interest rates, flexible EMI options, an easy application process, fast approval, and a disbursal period makes KreditBee one of a kind personal loan app.

Features:

-

Easy to apply process

-

Various types of loans are available

-

Low-interest rates and full transparency

-

Loan amount starts from ₹1,000 to ₹4,00,000

-

Loans are approvedfrom RBI registered banks

-

EMI repayment plans vary from 3 months to24 months

-

Personal loan for both salaried and self-employed

-

Digital processing and 10-minute loan disbursal

3. Bajaj Finserv

Bajaj Finserv is an all-in-one app for all your financial needs. The app allows you to recharge your mobile, pay your bills, apply for a personal loan, and do other financial-related things. You can even shop online for electronicgadgets andappliances. It is a great app that provides a comprehensive range of financial services. In terms of loans, Bajaj Finserv offers several types of loans including personal and Insta personal loans, business loans, home loans, and gold loans. Whether you are a salaried or self-employed individual, you can apply for its Insta personal loan,which offers you up to ₹10,00,000with flexible tenure of 6 months to 5 years atan interest rate of 13% to 36% p.a.

Features:

-

Easy to apply and paperless process

-

Various types ofloans including personal and business loans

-

Interest ratesvaryfrom 13% to 36% perannum

-

Get Insta personal loan of upto ₹10,00,000

-

No income proof is needed for Insta personal loans

-

EMI repayment plans vary from6 months to 5 years

-

Insta personal loans for a both salaried and self-employed individual

-

Fast processing of personal loans with a disbursal time of 30 minutes

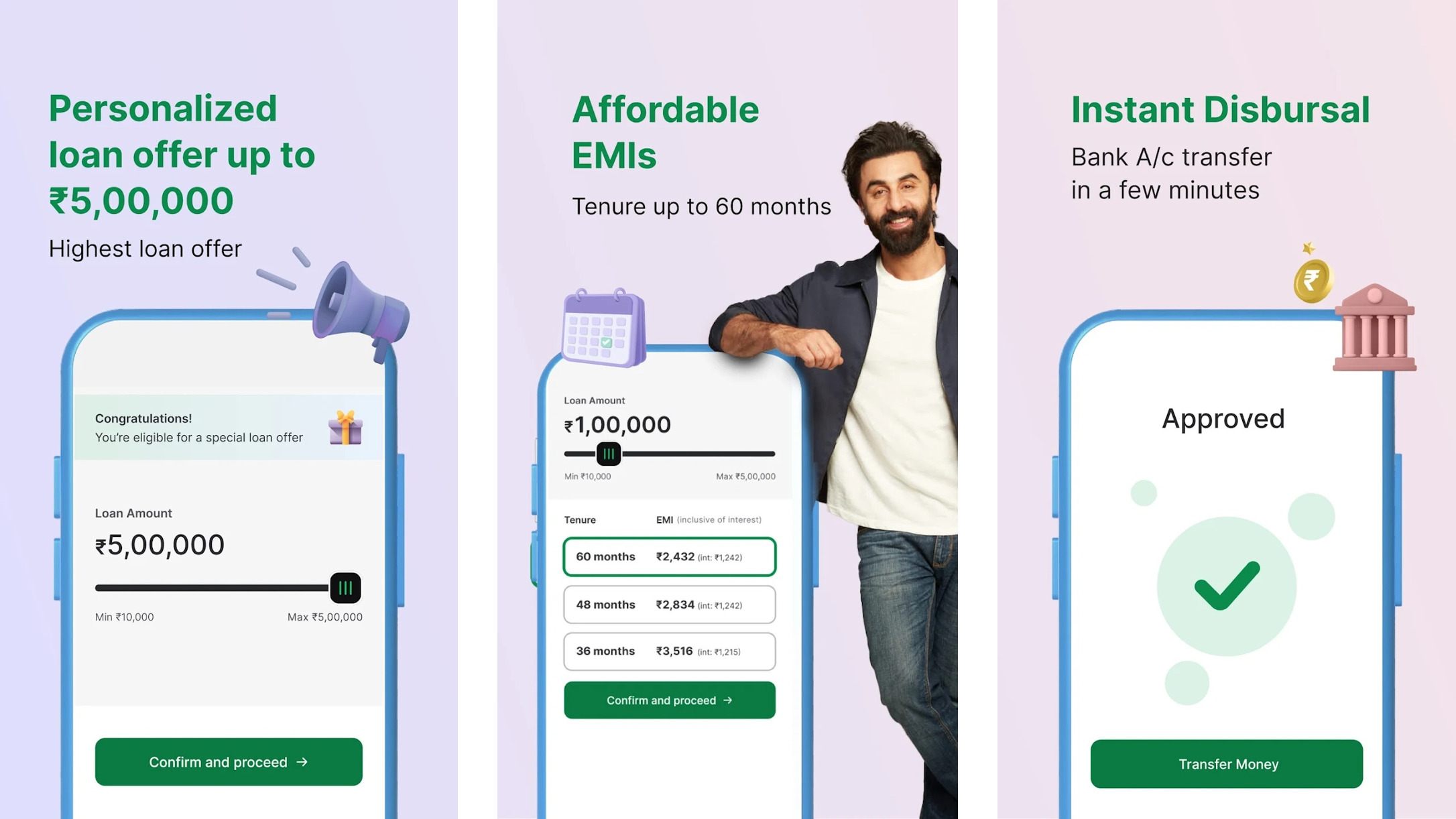

4. RapidRupee

Whether you have to pay bills or need cash urgently, you can opt for RapidRupeeto get an instant personal loan from₹1,000 to ₹60,000 with a low-interest rate i.e at 12% per annum and flexible repayment options ranging from 2 months to one year. RapidRupee provides several types of loans including personal loans for salaried individuals, small personal loans, cash loans, and self-employed loans. All you need is to be an Indian citizen of age 22 or above with a minimum income of ₹10,000 per month and minimal documents that include your Aadhaar card, PAN card, and selfie. Get your loan disbursed in 30 minutes with RapidRupee.

Features:

-

Digital processing with minimal documentation

-

Various types of personal loans

-

Interest rates start from just 12% perannum

-

Get personal loans from ₹1,000 to ₹60,000

-

Flexible loan tenure of upto 12 months

-

Personal loans for both salaried and self-employed individuals

-

Disbursalof loans in 30 minutes with processing fee starting at ₹349

-

Secured transactions with 128-bit SSL encryption.

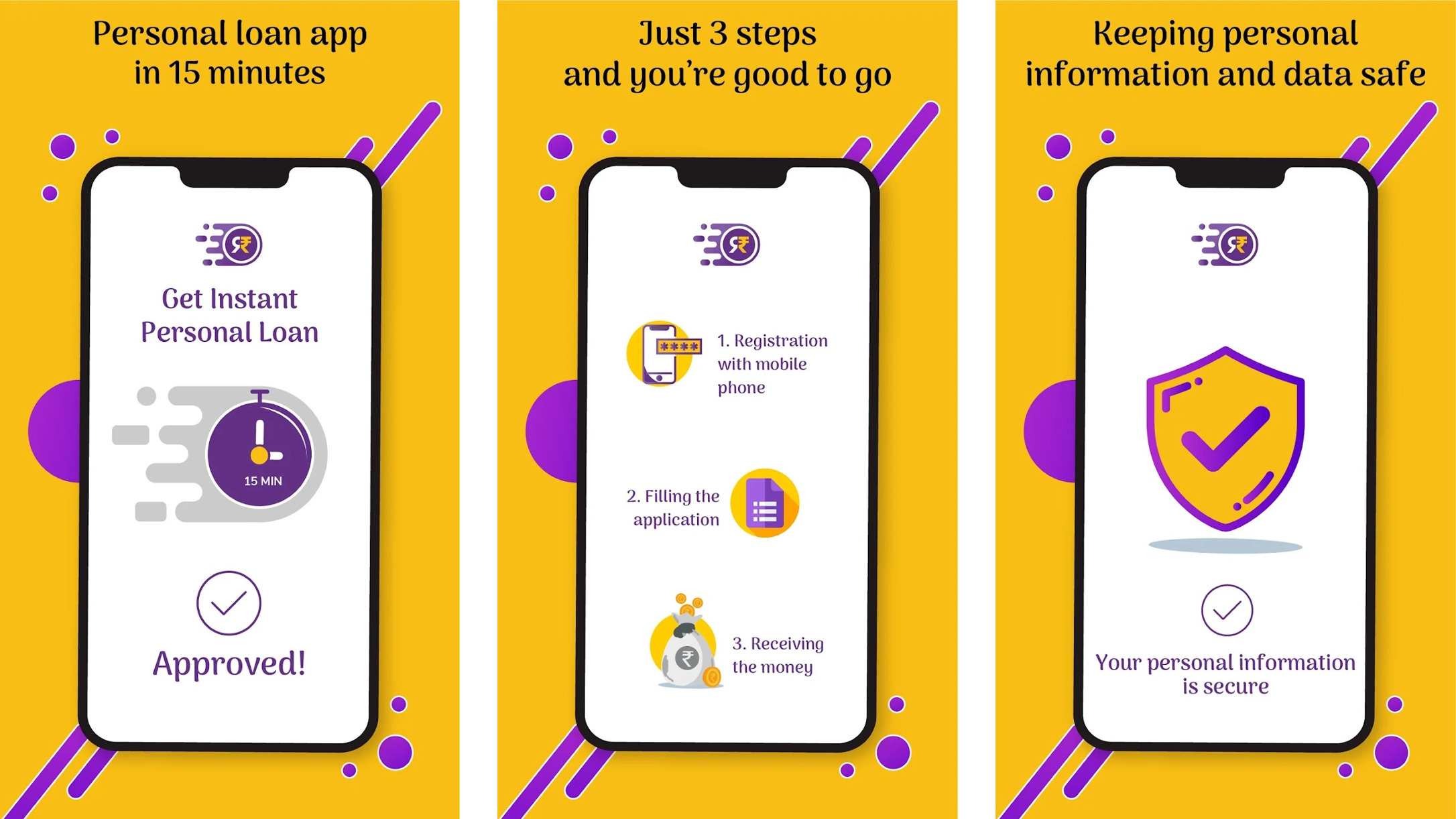

5. LazyPay

Formed under the Companies Act 2013, LazyPay Pvt. Ltd. is a unique and fabulous company that offersfour major types of financial services. The first one includes a personal loan where you can get up to ₹1,00,000 at an interest rate starting from 15% to 32% per annum and flexible EMI options ranging from 3-24 months. They have a very low processing fee of 2% and also launched XpressCash where you can get a personal loan of up to ₹5 lakhs. Their other products include Buy Now Pay Later, No-Cost EMI, and Scan & Pay Later. So if you loveshopping, you can use these services to shop online from popular websites and pay your shopping bills later.

Features:

-

Digital processing withminimal documentation

-

Get instant personal loan upto ₹1 lakh

-

Interest rates varyfrom 15% to 32% perannum

-

FlexibleEMI options from 3-24months

-

Buy Now Pay Later, No-Cost EMI, and Scan & Pay Later services

-

Shop online from various websites and pay later

-

Get instant credit with a 2% of the processing fee

-

Manage and track all your bills in the app itself

6. mPokket

You can use the mPokket app to get instant personal loans ranging from ₹500 up to ₹30,000 in just a few minutes, regardless of whether you are a salaried professional or a student. Trusted by more than 1.5 crore Indians, the app offers instantpersonal loanswithflexible EMIs repayment options and marginal documentation. Upon approval of the personal loan, the amount is directly credited to your bank account or Paytm wallet instantly. The processing and loan management feescost you between ₹50 to ₹200 excluding tax and the interest rates vary from 0% to 4% per month. So mPokket is a trustworthy and well-regulated personal loan app that you can use to get instant loans.

Features:

-

Easy to apply and paperless process

-

Various types of collateral-free loans

-

Interest rates range from 0% to 4% per month

-

Loan amountrangesfrom ₹500to ₹30,000

-

safe, secure and well-regulated

-

EMI repayment plans vary from61 days to 120 days

-

Personal loans for both salaried people and students

-

Loans are credited to the bank or Paytm wallet instantly

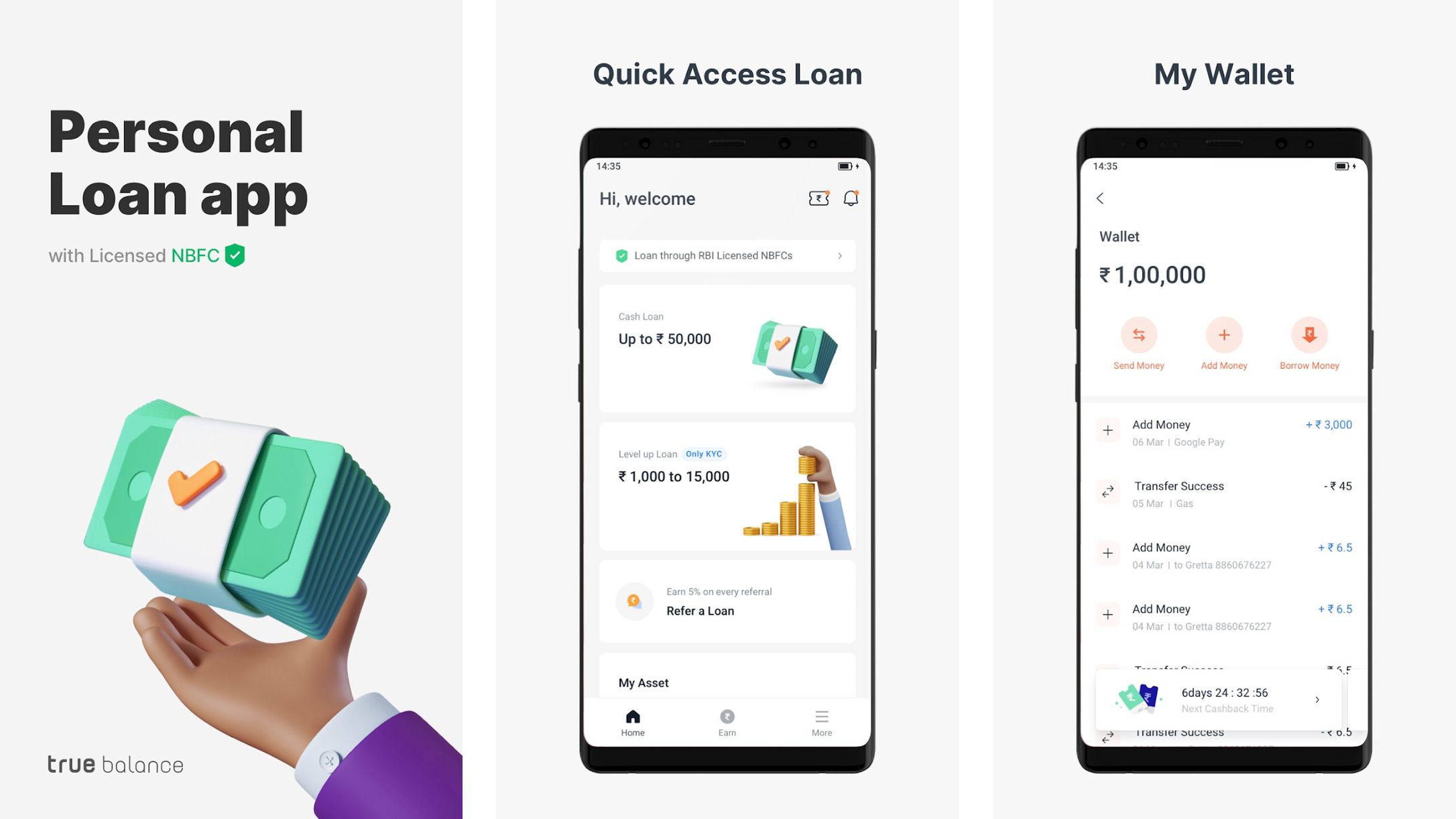

7. TrueBalance

Steering on the mission of “Finance For All,” True Balance is a popular lending and financial services platform that is 100% safe and secure. True Balanceprovides you with several types of loansranging from ₹ 1,000 to ₹ 1,00,000 for a tenure of 62 days to 6 months with a low processing fee and interest rate of 2.4% per month.They have minimal documents requirement and a loandisbursaltime of just 30 minutes.Their lending partners include True Credits, Mamta Projects, Grow Money, InCred, Muthoot Finance, and Vivriti Capital and all of them are RBI licensed. So you can ensure a safe and genuine financial service from them.

Features:

-

No paperwork and no bank visits

-

Various types of personal loans

-

Interest rate starting from 2.4% per month

-

All lending partners are RBI licensed

-

Personal loans ranging from ₹1,000 to ₹1,00,000

-

Flexible loan tenure ranging from 2 months to 18 months

-

Personal loans for both salaried and self-employed individuals

-

Quick approval of loans with a disbursal time of 30 minutes

8. Navi

Navi Finserv Limited is an RBI-registered NBFC that provides financial services like personal loans, health insurance, home loans, and mutual fund investments through its well-known app Navi. It offers instant collateral-free personal loans up to ₹20,00,000 at an attractive interest rate of just 9.9% per annum with flexibleEMI plans. The entire loan process is seamless and requires basic KYC and minimal documents. If you have a goodCIBIL score, then you can get your instant cash loan within 5 minutes at low-interest rates.

Features:

-

100% paperless process with minimal documentation

-

Various types ofcollateral-free loans

-

Interest rates start from just 9.9% perannum

-

Get personal loans upto to ₹20,00,000

-

Flexible loan tenure of upto 72 months

-

Personal loans for both salaried and self-employed individuals

-

Quickdisbursalof loans with zero processing fee

-

Other financial services like MF, health insurance, etc.

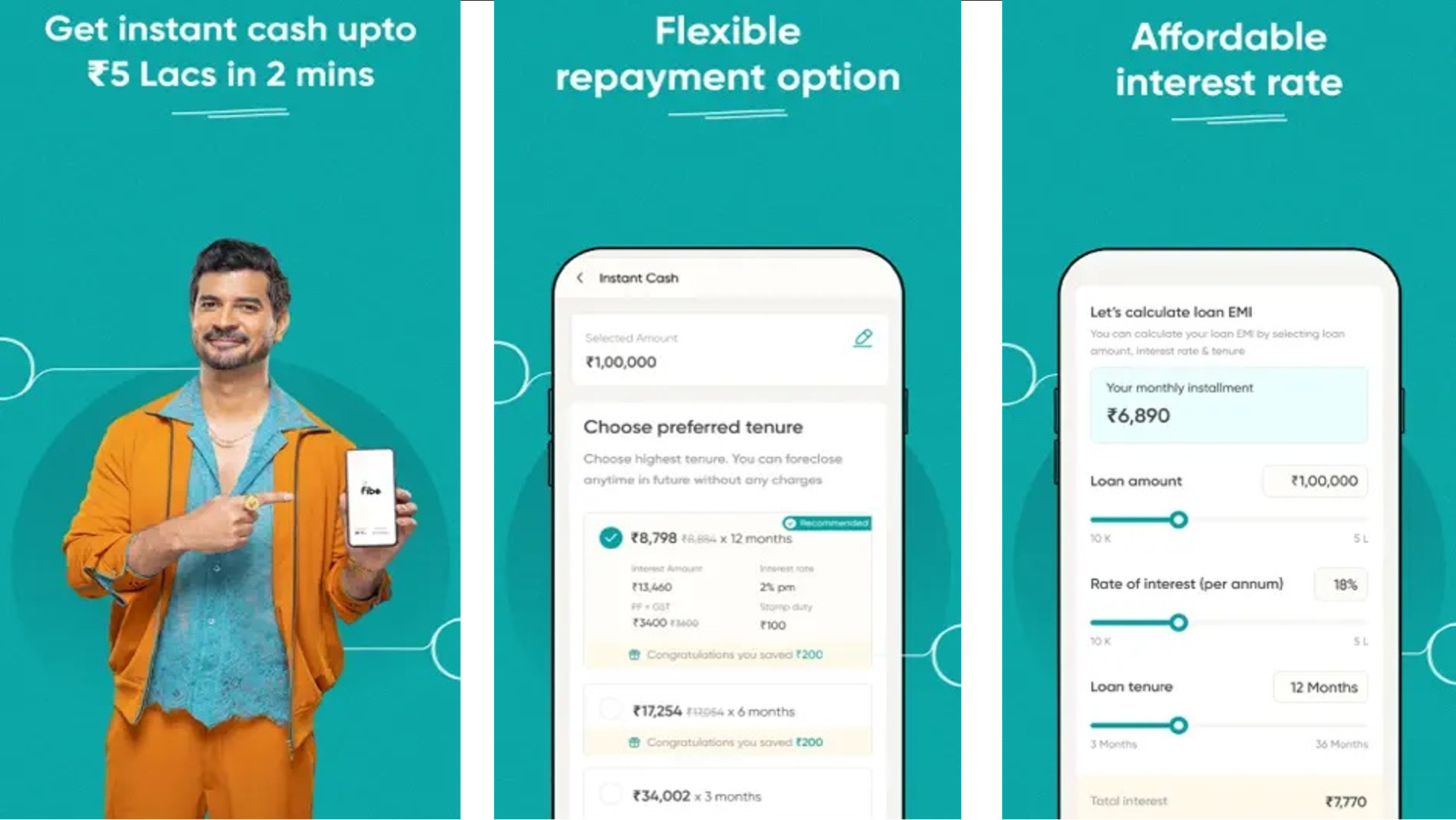

9. Fibe

The Fibe Instant Personal Loan App provides swift and effortless access to personal loans with immediate approval.It provides a simple application process and flexible repayment options, as well as transparent terms and fees. The app is a convenient and accessible option for those in need of a hassle-free personal loan. Their instant cash loan starts from ₹8,000 to ₹10,00,000 at an interest rate of 12%-30% per annum and flexible EMI options ranging from 3 months to 36 months. They too have Buy Now Pay Later services where you can buy products online and pay your bills at your convenience.

Features:

-

Digital processing withminimal documentation

-

Various types of loan products

-

No pre-payment charges

-

Loan starts from ₹8,000 to ₹10,00,000

-

Interest rates varyfrom 12%-30% per annum

-

FlexibleEMI options from 3-36 months

-

Buy Now Pay Later,Instant Salary Advance, and other services

-

Instant approval and quick disbursal

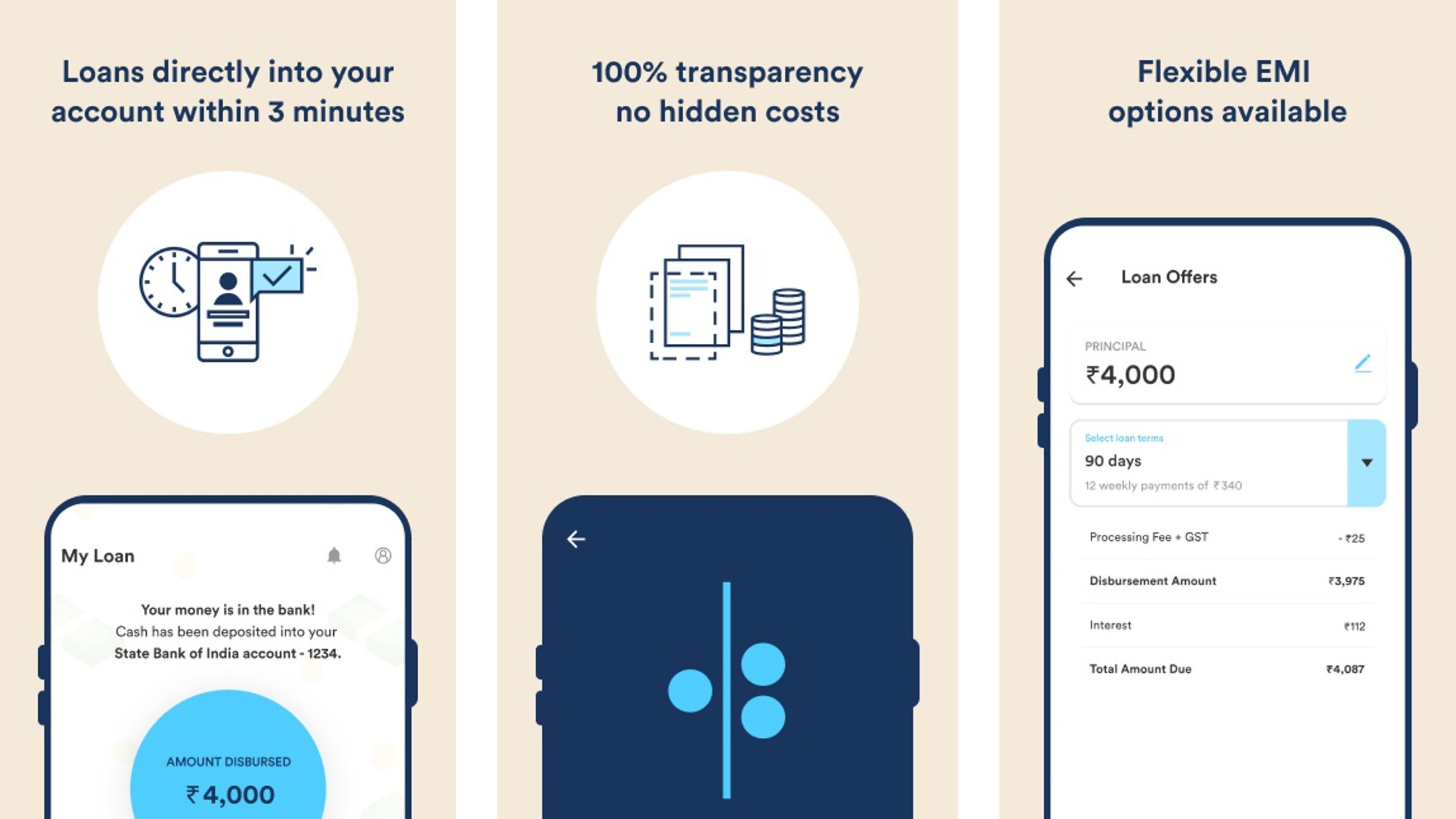

10. Branch

The branch is a mobile app that provides personal cash loans to users in need of fast and convenient access to funds, without hidden fees or collateral requirements. The borrowing process is paperless, andyou can apply for various types of loans and receive funds at an interest rate starting from 2% per month. The branchis an RBI-registered NBFC thatoffers flexible repayment options, allowing you to choose your terms and pay back your loans in installments that range from 2-6 months.Itprioritizes user security and offers excellent customer support to assist you with any questions or concerns.

Features:

-

RBI registered NBFC

-

Digital processing withminimal documentation

-

Various types of collateral-free loans

-

Loan startsfrom₹750 to ₹50,000

-

APRvariesfrom 24%-36% per annum

-

FlexibleEMI options from 2-6 months

-

Safe and secure loans